There’s a lot to be said about stock options. At its core, a stock options contract is an agreement between two parties to facilitate a potential transaction involving a stock at a predetermined price and date. It sounds simple, but once you dig deeper, you’ll find that options can offer a multitude of strategies for enhancing your investment portfolio.

When you buy an option, you gain the right—but not the obligation—to purchase or sell an underlying asset, such as a stock. Each options contract typically represents 100 shares of the underlying stock, and these contracts are also available for most popular ETFs.

Most investors use options to speculate on the potential upside or downside of a stock, but there’s much more to them. Options can protect your stock positions from market drops, generate income, and allow you to profit from volatility even if you’re unsure of the market’s direction. If you’ve ever wondered how to prepare to buy a stock at a lower price or increase your income from an existing stock position, options might be the tool you need. Let’s dive into the basics.

Understanding Calls and Puts

An option is an agreement between two parties: the buyer and the seller. The seller, also known as the option writer, makes a promise and receives a premium. The buyer has a choice and pays the premium. There are two main types of options: Calls and Puts.

- Call Option: The buyer of a call option has the right, but not the obligation, to purchase the underlying stock at a predetermined price within a specified period. The seller of the call option is obligated to sell the stock at this price if the buyer decides to exercise their right.

- Put Option: The buyer of a put option has the right, but not the obligation, to sell the underlying stock at a predetermined price within a specified period. The seller of the put option is obligated to buy the stock at this price if the buyer decides to exercise their right.

Key Terminology

Before we get into strategies, it’s essential to understand some key terms associated with options:

- Strike Price: The predetermined price at which the option can be exercised.

- Premium: The amount the buyer pays for the option, which the seller receives.

- Expiration Date: The final date on which the contract is valid. After this date, the option becomes void and can only be exercised if it’s in the money.

- Intrinsic Value: The difference between the price of the underlying stock and the strike price. This is the value of the option if it were to be exercised right now.

- Extrinsic Value: The additional value of the option based on factors such as time to expiration, implied volatility, and market demand.

For example, if a call option has a premium of $2, this price covers 100 shares, making the actual cost of the option $200.

Moneyness of Options

The concept of “moneyness” helps determine whether an option is worth exercising at a given time:

- At the Money: When the stock price matches the option’s strike price.

- In the Money: A call is in the money if the stock price exceeds the strike price; for puts, it’s the opposite.

- Out of the Money: A call is out of the money if the stock price is below the strike price, while a put is out if the price exceeds it.

The Greeks: Measuring Option Sensitivity

Options pricing is influenced by several factors, collectively known as “the Greeks”:

- Delta: Measures how much the price of the option is expected to move for a $1 change in the underlying stock price. Call options have positive deltas, while put options have negative deltas.

- Gamma: The rate of change in delta, indicating how delta will shift as the stock price changes.

- Theta: Also known as time decay, this measures how much the price of an option decreases as the expiration date approaches.

- Vega: Measures the sensitivity of the option price to changes in implied volatility.

- Rho: The sensitivity of the option price to changes in interest rates, though this typically has a minor effect.

Practical Examples: Long and Short Strategies

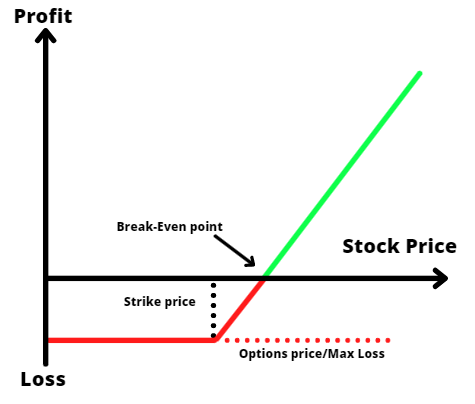

Long Call

Buying a call option (a long call) gives you the potential to profit from a rising stock price. If the stock price ends between the strike price and the breakeven point (strike price + premium paid), you may incur a small loss due to time decay. If the stock price rises above the breakeven point, you stand to make a profit.

For instance, let’s say stock XYZ is trading at $50. You buy a call option with a strike price of $50, expiring in 30 days, and pay a $2 premium ($200 total). If XYZ’s price rises to $60, your option’s intrinsic value will be $10 per share, or $1000 for the contract. After subtracting the premium, your net profit would be $800.

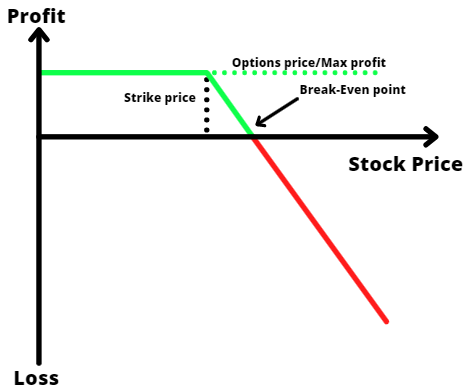

Short Call

Selling a call option (a short call) involves taking on the obligation to sell stock at the strike price if the buyer exercises the option. This strategy is often used when you expect the stock price to remain flat or decrease.

Let’s say stock ABC is trading at $75. You sell a call option with a strike price of $75, expiring in 30 days, for a $2 premium. If ABC stays at or below $75, the option expires worthless, and you keep the $200 premium. If the stock rises to $80, you may face significant losses as you’ll need to buy the stock at the higher market price to fulfill the contract.

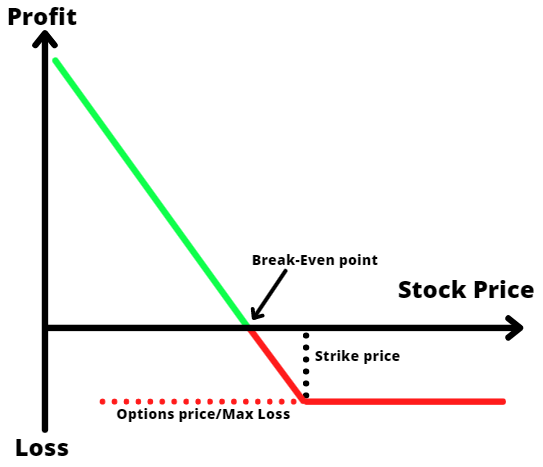

Long Put

A long put is a bet that the stock price will decline. If the stock price drops below the strike price minus the premium paid, the option becomes profitable. This strategy is also used to hedge long stock positions.

For example, if XYZ is trading at $50 and you buy a put option with a strike price of $50 for a $2 premium, the breakeven point is $48. If the stock falls to $40, your option’s intrinsic value will be $10 per share, yielding a net profit of $800.

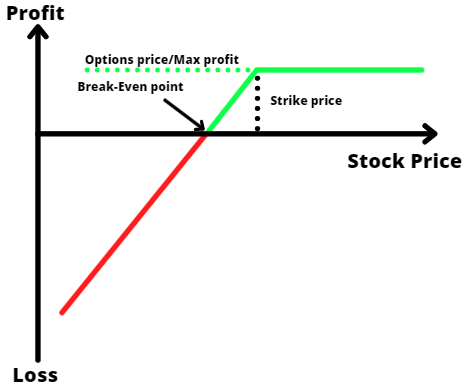

Short Put

Selling a put option (a short put) involves the obligation to buy the stock at the strike price if the option is exercised. This strategy can be used to generate income or acquire stock at a lower price.

For example, if ABC is trading at $22 and you sell a put with a strike price of $22 for a $1 premium, you keep the $100 premium if the stock stays above $22. If the stock drops to $18, you may be forced to buy the stock at $22, resulting in a loss.

The Start of a New Journey

I know it seems like a lot of math, but in reality, your broker platform will calculate the options prices for you and show your profit and loss in real-time. The important part is understanding the basics so you can trade options safely and avoid unpleasant surprises.

Now that you have a good grasp of the fundamental types of options, you can start exploring the vast array of strategies that can be tailored to different market conditions. Whether you’re looking to generate passive income, protect your stock positions, or leverage your investments, options offer versatile tools to help you achieve your financial goals.

Interested in generating extra income?

My book 7 Ways To Generate Income With Options details seven strategies that can boost your income regardless of market conditions.