When it comes to building a successful investment portfolio, reliable stock recommendations can be invaluable. Seeking Alpha, a trusted name in investment research, offers a premium service known as Alpha Picks, designed specifically to deliver carefully curated stock recommendations. Promising significant gains through a straightforward approach, Alpha Picks has sparked interest among investors looking for a simple yet effective investment tool. But is it truly worth the annual subscription cost of $449? And how does it compare to broader market benchmarks?

Website: https://www.seekingalpha.com

Owner: Seeking Alpha Ltd.

Product: Alpha Picks

Inception Date: July 2022

Pricing:

- Alpha Picks: $499/year (currently discounted to $449)

- Free Trial: No free trial specifically for Alpha Picks, though other Seeking Alpha plans offer trial options.

Target Audience: Long-term investors looking for simplified, high-potential stock recommendations without needing in-depth research or portfolio management tools.

Support Options: Email Support, Knowledge Base, Community Forums

Key Features:

- Two hand-picked stock recommendations per month

- Data-driven, quantitative stock analysis

- Detailed stock breakdowns and justifications for each pick

- Alerts for portfolio updates and significant stock changes

- Editorial insights combined with quantitative analysis

Best For: Investors focused on long-term growth who want an easy-to-follow, reliable way to add high-potential stocks to their portfolios without excessive analysis.

Final Verdict: Alpha Picks offers an excellent, simplified solution for investors seeking high-quality stock recommendations based on Seeking Alpha’s rigorous quantitative and editorial expertise. With a strong track record of market outperformance, it’s a valuable tool for investors looking to build long-term wealth with minimal effort. However, it may feel limiting for those who prefer frequent trades or more diverse picks.

Rating: 8.5/10

In this review, we’ll explore the key features, benefits, performance, and potential drawbacks of Alpha Picks to help you decide if it’s the right choice for your financial goals.

What Is Seeking Alpha’s Alpha Picks?

Seeking Alpha is a popular investment research platform with a large community of investors, analysts, and contributors who share insights and opinions on a wide range of stocks and financial topics. Alpha Picks is one of its premium subscription services that aims to simplify investing decisions by providing two carefully selected stock recommendations each month.

These recommendations are based on a combination of quantitative analysis and editorial expertise. The primary goal is to identify undervalued stocks with high growth potential, focusing on companies that may outperform the broader market over the long term.

Who Is Alpha Picks For?

Alpha Picks is ideal for individual investors who don’t have the time or expertise to conduct in-depth stock research but still want to invest strategically. If you’re looking to add high-potential stocks to your portfolio without spending hours analyzing financial statements, Alpha Picks could be the perfect fit. It’s also suitable for investors looking to build wealth over the long term and diversify their portfolios.

Alpha Picks’ Performance vs. the S&P 500

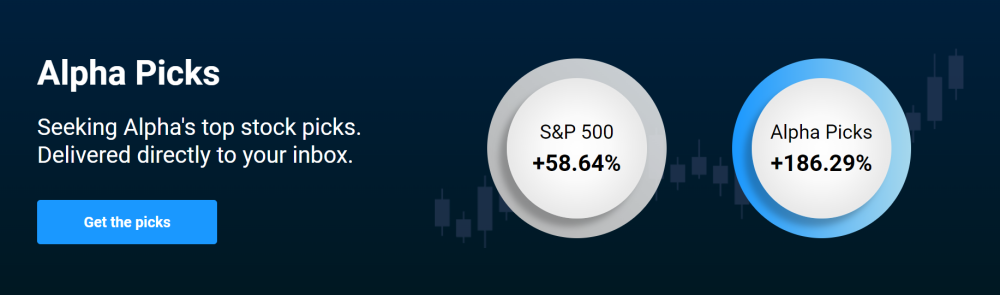

One of the most impressive aspects of Alpha Picks is its historical performance. Since its inception, Alpha Picks has delivered notable returns:

One of the most impressive aspects of Alpha Picks is its historical performance. Since its inception, Alpha Picks has delivered notable returns:

- Alpha Picks Performance: +186.29%

- S&P 500 Performance: +58.64%

This data underscores the potential for substantial returns with Alpha Picks recommendations. The Alpha Picks portfolio has significantly outperformed the S&P 500 index, providing a compelling case for its value in identifying high-growth stocks. While past performance doesn’t guarantee future success, these results showcase Alpha Picks as a powerful tool for long-term investors seeking higher returns than the market average.

How Does Alpha Picks Work?

Alpha Picks operates with a streamlined, easy-to-follow process:

- Rigorous Selection Process: Seeking Alpha’s quantitative models evaluate a broad range of stocks based on metrics like earnings growth, valuation, profitability, and momentum. The selections are then reviewed by the editorial team to add qualitative insights and ensure only high-potential stocks make it to the list.

- Monthly Recommendations: Each month, subscribers receive two stock recommendations that Seeking Alpha’s models have flagged as undervalued and positioned for growth. This approach is tailored to investors looking for long-term gains rather than quick trades.

- Detailed Analysis and Justification: For each recommendation, Alpha Picks provides a detailed breakdown that explains why the stock was selected, offering insights into key financial metrics, industry context, and comparative analysis against its peers.

- Alerts and Portfolio Updates: Subscribers receive alerts about significant changes in the performance or outlook of previously recommended stocks, helping them stay updated on their investments.

Key Benefits of Seeking Alpha’s Alpha Picks

Alpha Picks offers several advantages that make it a valuable tool for individual investors:

1. Simplifies Investment Decisions

For those overwhelmed by the vast number of investment choices, Alpha Picks streamlines decision-making by offering only two high-quality stock recommendations each month. This minimalistic approach helps investors focus on a few solid choices without sifting through extensive research reports or hundreds of stocks.

2. Data-Driven, Quantitative Analysis

Alpha Picks recommendations are rooted in Seeking Alpha’s proprietary quantitative analysis, which evaluates stocks based on earnings growth, profitability, valuation, and other key financial metrics. This data-driven approach provides a layer of objectivity, helping investors trust that the recommendations are backed by reliable financial indicators.

3. Backed by Editorial Expertise

Beyond quantitative analysis, Alpha Picks benefits from Seeking Alpha’s experienced editorial team, who review the picks and provide additional insights. This combination of quantitative rigor and qualitative insight makes each recommendation well-rounded and easier to understand for investors at all levels.

4. Long-Term Investment Focus

Alpha Picks isn’t for day traders or short-term speculators. Instead, it’s designed for investors who are interested in building wealth over the long term. By focusing on undervalued companies with growth potential, Alpha Picks helps users cultivate a portfolio intended to appreciate steadily over time.

5. Affordable Pricing Model

With a subscription fee of $449 per year, Alpha Picks is relatively affordable compared to the costs associated with financial advisors or other premium stock-picking services. Given its strong performance history, many users consider the annual fee a worthwhile investment for access to high-quality stock recommendations.

Potential Drawbacks of Alpha Picks

While Alpha Picks has many strengths, it may not be ideal for everyone. Here are some potential limitations to consider:

1. Limited Number of Recommendations

Alpha Picks provides only two recommendations per month, which may feel restrictive for investors seeking a broader selection. However, this narrow focus can also be an advantage, as it encourages users to concentrate on quality over quantity.

2. Not Suitable for Short-Term Trading

Given that Alpha Picks emphasizes long-term growth potential, it may not be ideal for those interested in short-term gains or day trading. If your investment strategy relies on quick market movements, Alpha Picks may not align with your approach.

3. One-Size-Fits-All Recommendations

Alpha Picks is designed as a universal service, meaning every subscriber receives the same recommendations. While this structure simplifies the service, it may not suit investors with specific industry preferences or unique portfolio needs.

4. Relies on Seeking Alpha’s Methodology

The performance of Alpha Picks relies on Seeking Alpha’s proprietary model and editorial expertise. While these methods have proven effective, it’s always wise to consider diverse sources when making investment decisions and to avoid relying entirely on any single tool.

Alpha Picks Performance: Does It Deliver on Its Promise?

The historical performance of Alpha Picks has demonstrated impressive returns, as evidenced by its +186.29% gain compared to the S&P 500’s +58.64% during the same period. This strong track record indicates that Alpha Picks’ methodology can identify stocks with significant upside potential. However, it’s important to remember that stock market performance is inherently unpredictable, and no investment tool can guarantee future gains.

Pricing and Subscription Options

The annual subscription cost of $449 makes Alpha Picks relatively affordable compared to more traditional financial advisory services. Subscribers gain access to the monthly recommendations and performance updates, along with detailed analysis for each pick. The price is particularly reasonable considering the service’s historical outperformance of the S&P 500.

For investors seeking a straightforward, high-performance stock-picking service, Alpha Picks could represent a valuable addition to their investment toolkit, especially if their primary goal is long-term wealth accumulation.

Is Alpha Picks Right for You?

Alpha Picks may be a great choice for:

- Long-Term Investors: Those focused on long-term growth, with a patient and steady investment strategy, will find Alpha Picks aligns with their goals.

- Investors Seeking Simplicity: Alpha Picks distills complex investment decisions into two monthly recommendations, making it ideal for those who prefer a simplified approach to stock selection.

- Cost-Conscious Investors: With an annual fee of $449, Alpha Picks offers high-quality stock recommendations at a price that’s lower than many financial advisory services.

However, it may not be ideal for:

- Short-Term Traders: Those looking for quick gains or frequent trading opportunities might find Alpha Picks’ long-term focus limiting.

- Investors Seeking Customization: Alpha Picks offers the same recommendations to all users, which may not satisfy those with unique investment preferences.

Final Verdict: Is Alpha Picks Worth the Investment?

With its combination of quantitative rigor and editorial expertise, Seeking Alpha’s Alpha Picks offers a straightforward and reliable way to invest in high-potential stocks. Its historical outperformance of the S&P 500 makes it an attractive option for investors focused on long-term growth. At $449 per year, Alpha Picks provides significant value through its quality recommendations and ease of use.

Pros:

- Significant outperformance of the S&P 500

- Simplified, actionable monthly stock recommendations

- Data-backed analysis and expert insights

- Cost-effective compared to many premium investment tools

Cons:

- Limited to two picks per month

- Requires a long-term commitment

- Lacks customization for individual portfolios

In conclusion, Alpha Picks is a solid choice for investors who value quality over quantity, focusing on long-term growth through high-potential stock picks. Its cost-effective pricing and strong historical performance make it an attractive option for anyone looking to build wealth steadily in the stock market. While it may not suit short-term traders or highly active investors, Alpha Picks could be a valuable resource for those with a patient investment outlook and a commitment to long-term gains.

In a world of endless investment choices, having a reliable tool like Seeking Alpha’s Alpha Picks can make all the difference. If you’re ready to streamline your stock selection and invest with confidence, this service has a proven track record of outperformance against the market. Usually priced at $499 per year, Alpha Picks is now available with an exclusive $50 discount through this link, bringing it down to $449 for a limited time.

Don’t miss this opportunity to invest smarter and save big. Click here to claim your discounted subscription to Seeking Alpha’s Alpha Picks and start receiving expert-backed stock recommendations today!

Here’s a little transparency: Our website contains affiliate links. This means if you click and make a purchase, we may receive a small commission. Don’t worry, there’s no extra cost to you. It’s a simple way you can support our mission to bring you quality content.